Smartphone Shipments Predicted to Fall Again

Article By : Dylan McGrath

After declining for the second straight year in 2018, smartphone sales appear to be poised to fall again this year amid a global trade war and macroeconomic uncertainty.

SAN FRANCISCO — The smartphone has been a main driver of the semiconductor industry for the past several years, ever since PC shipments began to decline in 2012. But that may be a thing of the past. With challenging market conditions persisting, analysts say shipments may well decline again this year.

"Globally, the smartphone market is a mess right now," said Ryan Reith, vice president of IDC's Worldwide Mobile Device Trackers program, in a press statement.

According to Reith, other than a handful of high-growth markets like India and South Korea, markets were down across the board. IDC blames the declines on multiple factors, including longer phone replacement cycles, increasing penetration in large markets and political and economic uncertainty.

Reith also cited "growing consumer frustration around continuously rising price points."

Smartphone shipments fell by 4.1% last year to 1.4 billion units, according to IDC. It was by far the biggest annual decline for smartphone shipments after they declined by less than 1% in 2017, the first ever decline in annual shipments.

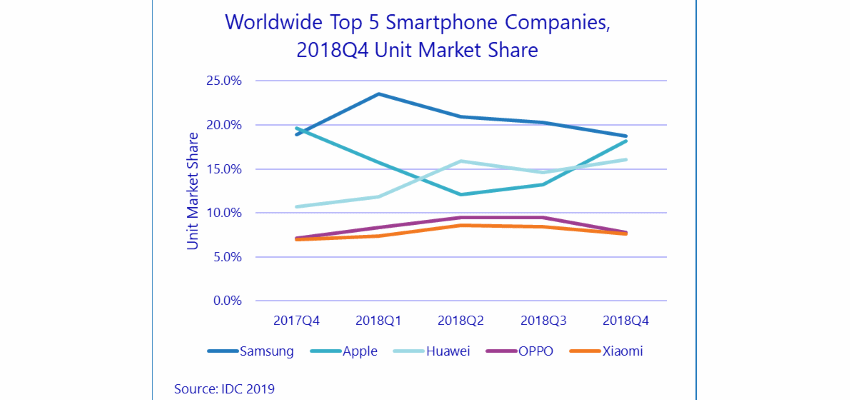

Fourth quarter smartphone shipments totaled 375.4 million, down by 4.9% compared with the fourth quarter of 2017 and marking the fifth consecutive quarter of year-over-year shipment declines, according to IDC.

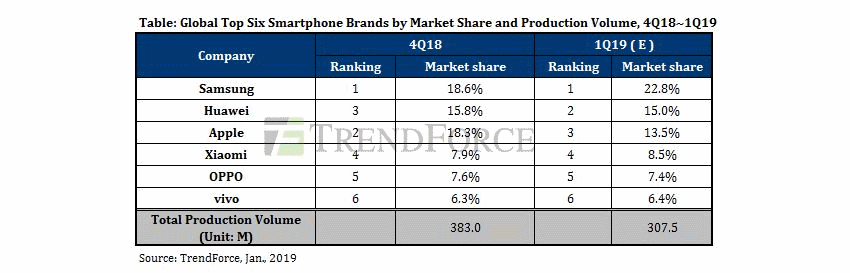

What's more, smartphone makers began scaling back production plans in the fourth quarter amid slacking consumer demand, paying more attention to inventory management, according to Trendforce, a Taipei-based research firm. Trendforce forecasts that first quarter smartphone production will be about 307 million units, down 10% from the first quarter of 2018.

The biggest concern is China, which accounts for about 30% of the world's smartphone consumption. According to IDC, the Chinese smartphone market performed even worse in 2018 than the rest of the world, with volumes declining by more than 10%.

IDC cites high inventories and consumer spending on smartphones, which was down overall, for the Chinese market woes. The top four brands in China — Huawei, OPPO, vivo and Xiaomi – grew their share of the China market to roughly 78% from 66% in 2017, according to the firm.

Globally, the top five smartphone vendors — Samsung, Huawei, Apple, OPPO and Xiaomi — increased their share of the overall smartphone market to 69% from 63% in 2017, IDC said.

Anthony Scarsella, a research manager with IDC's Worldwide Quarterly Mobile Phone Tracker program, said the arrival of 5G and foldable smartphones later this year could breathe new life into the smartphone market. However, IDC expects these phones to carry a hefty premium, at odds with consumers' growing frustration with being asked to shell out more for new devices.

"With replacement rates continuing to slow across numerous markets, vendors will need to find a new equilibrium that balances the latest smartphone features, compelling design, and affordability," Scarsella said.