A Chinese Perspective of India’s Manufacturing Industry, Part 1

Article By : Jenny Liu

A delegation recently travelled to India to get the lie of the land and to puzzle out investment opportunities for Chinese companies. The following is a candid report by Jenny Liu, the head of the overseas delegation.

Due to the China-US trade war, many companies have set their sights on Southeast Asia to avoid trade barriers and the semiconductor industry is no exception. More and more readers ask: Do Chinese companies have a policy to support investment in India? What are the rules for foreign exchange trading? What is the policy on land sales? Which areas should I go to invest in India? In India, where is the opportunity for Internet entrepreneurship?

What a series of questions!

Recommended

This article is a translation of an article that originally appeared in ESM China:

2019考察手记告诉你:印度制造业,到底值不值得投资?

With these questions in mind, IC Superman teamed up with 36Kr once again on this magical land and visited Invest India, local government representatives and an array of companies. The following is a report by Jenny Liu, Co-founder of IC Superman and head of the overseas delegation.

India's business environment and investment dividends

With Indian tax reform and Demonetization advocated by the Modi government, India is forming a unified market. As India’s business environment continues to improve, along with market efficiency, foreign investment has risen in tow. Driven by the growth of personal consumption levels, India's economic growth rate is strong at 6.1%.

During Prime Minister Modi’s first Independence Day speech post re-election, he set the lofty goal of doubling India’s nominal GDP to $5 trillion USD in the next five years. He also promises to invest 100 trillion rupees ($1.43 trillion) into improving India’s infrastructure such as new roads, railways, bridges and hospitals.

There are also plans to push through reform to optimize the business environment and vigorously develop the digital payment and tourism industries.

"If you want to get rich, build roads first", the essence of this Chinese economic development plan has also been learned by the Modi government. Data from the World Bank's 2019 World Business Report shows that India's business environment has improved significantly, now on a similar level to Indonesia and Vietnam.

However, it is worth noting that India's domestic manufacturing industry is relatively lagging behind and unable to meet the rapidly growing demand for production and consumption. The situation is also exacerbated by a large number of industrial and civilian products relying on imports.

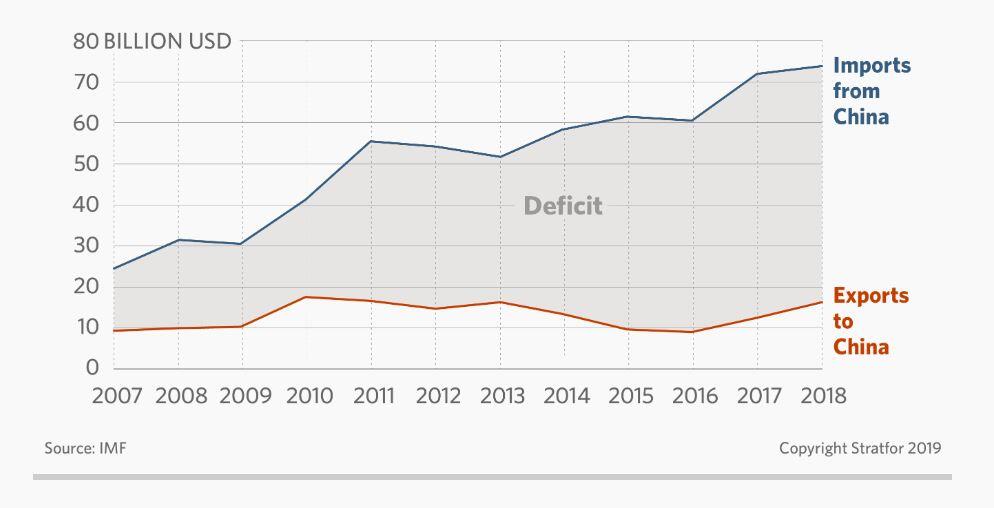

Sino-Indian trade totaled $95.5 billion USD in 2018, but China’s trade surplus with India was as high as $57 billion USD. Among them, mechanical and electrical products, chemical products and metals were the top three commodities imported by India from China, accounting for 76% of total imports.

On the second day of the delegation’s trip in India, the delegation visited Invest India (the only investment promotion agency of the Central Government of India in New Delhi, similar to the China Development and Reform Commission), which was established in 2009. In the New Delhi office, Invest India has a team of 40 investment experts who are responsible for working with all central government departments (including the office of Indian Prime Minister Narendra Modi) and state government agencies to help foreign investment.

Recommended

A Chinese Perspective of India’s Manufacturing Industry, Part 2

It is understood that as the Modi government's investment in infrastructure increases, the Indian government has also increased investment and subsidies for new energy vehicles. However, the implementation of this policy has not been able to keep up with the supply chain and it has encountered great resistance.

The current condition of manufacturing enterprises in India

The next stop for the delegation is MCM, a manufacturing company that specializes in mobile communications, smart hardware and digital accessory processing plants. The development of MCM in India is the epitome of China's mobile phone industry going to India.

As the Indian government has continued to raise tariffs, mobile phone brand manufacturers and supply chain companies have been forced to set up factories in India to reduce costs. MCM was established in May 2015 and started production in July. It is the earliest batch of Chinese-funded communication products in Noida. It currently has 5 Surface-mount technology (SMT) lines with a monthly production capacity of 1M plus 24 assembly lines and 12 packaging lines with an assembly monthly capacity of 1.5M units.

What about “workers' wages, productivity and factory capacity?” The heads of MCM have answered: “Firstly, the monthly minimum wage for Indian workers is $99 USD. The wages of workers in general factory production lines is around $170 USD and recruitment is very easy, but overtime is still not very popular. Secondly, despite having standardized and streamlined management, worker productivity remains low. Through the management of the sister factory BJD (the assembly plant of power products), MCM has increased the capacity of the assembly plant to that of the Chinese plants. The capacity of the SMT plant can reach 80% of the Chinese level; it seems that the core of work efficiency and capacity is still in management".