India Smartphone Market Defies Global Decline

Article By : Matthew Burgess

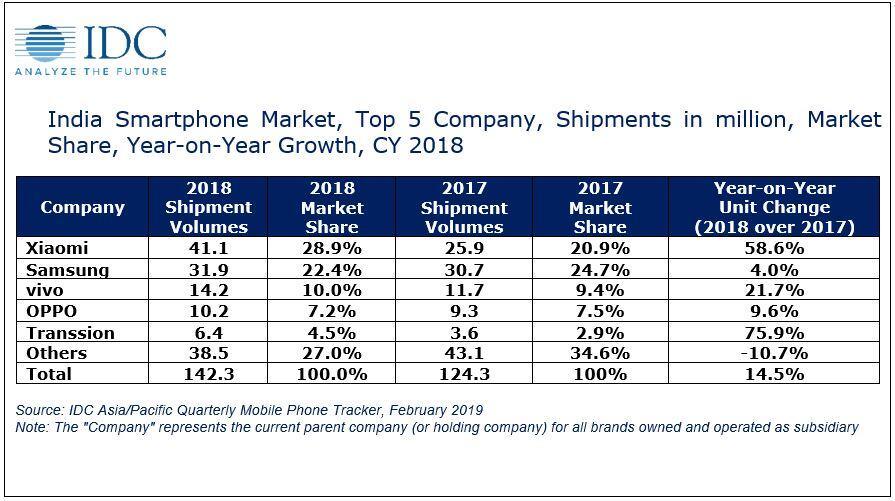

Whilst global sales flounder, Online-focused brands are the highlight of 2018 after exponential growth helps India ship 142.3 million units.

With an ever-persistent global trade war and macroeconomic uncertainty, perhaps the continued decline in global smartphone sales doesn’t come as a surprise. Despite this adversity, the Indian smartphone market shipped a record 142.3 million units in 2018, a startlingly healthy 19.5% annual growth. Success has primarily been attributed to multiple rounds of sales by e-tailers beyond the festive Diwali period lasting into December.

“Amongst the big highlights of 2018 were the online-focused brands that drove the share of the online channel to an all-time high of 38.4% in 2018 and a whopping 42.2% in 2018 Q4” Upasana Joshi, Associate Research Manager, Client Devices, IDC India.

According to Joshi, e-tailers have been lauded for their success in driving affordability through various financing options, cashback offers and buyback schemes. The success of e-tailers was also buoyed by the demand for online-exclusives, such as Xiaomi, Asus & OnePlus. The offline channel remains the largest channel for mobile phone distribution in India but only managed 6.7% annual growth in 2018, a somewhat subdued figure when compared to its online counterpart.

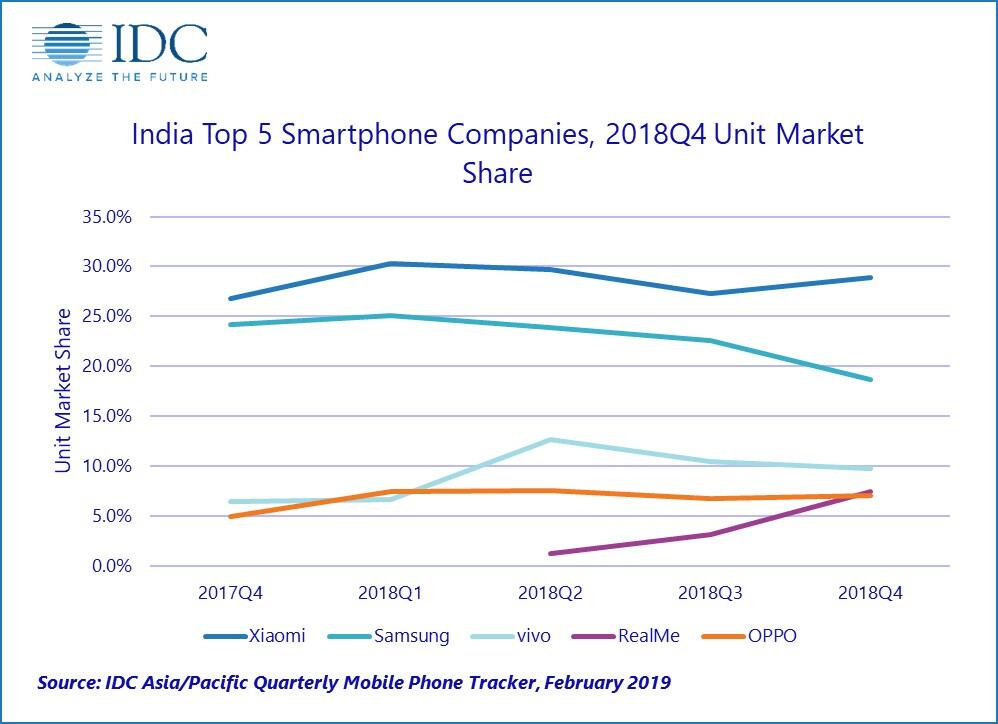

Company Highlights: CY 2018 and 2018 Q4

The Indian market was one of the few to experience high growth in 2018, as smartphone makers sought to scale back production in Q4. The IDC has blamed the decline on multiple factors, including longer phone replacement cycles, increasing penetration in large markets and political and economic uncertainty.

"Globally, the smartphone market is a mess right now," said Ryan Reith, vice president of IDC's Worldwide Mobile Device Trackers program, in a press statement.

Reith also cited "growing consumer frustration around continuously rising price points."

According to the IDC, the Chinese smartphone market performed even worse in 2018 than the rest of the world, with volumes declining by more than 10%. This will be of great concern for manufacturers as China accounts for about 30% of the world's smartphone consumption. This would have surely played apart in the biggest annual decline for smartphone shipments as they fell by 4.1% to 1.4 billion units.

India 2019 Forecast:

Commenting on the outlook for 2019, Navkendar Singh, Associate Research Director, Client Devices & IPDS, IDC India mentions “Almost all the brands which were able to find traction in 2018 via e-tailers partnerships have already started their offline foray to establish themselves for the long-term. This has become more crucial as the new e-commerce guidelines come into force from 1st February 2019.

In 2019, we will see improvements in design like thinner bezels, eliminated notches, hole-punch screens, and increased promotions around three or four rear cameras, of which the utilitarian factor remains for – bokeh, wide angle, portraits, etc. We might also see innovations like on-device AI for superior video and photography experiences enabled going forward.”